All Press Releases for January 27, 2022

National Loans Explains Asset Loans for Private Sales

Buying a used asset, such as a car or boat, can be a great way to score some significant savings, however buying a privately sold asset with finance can involve a few more hoops to jump through.

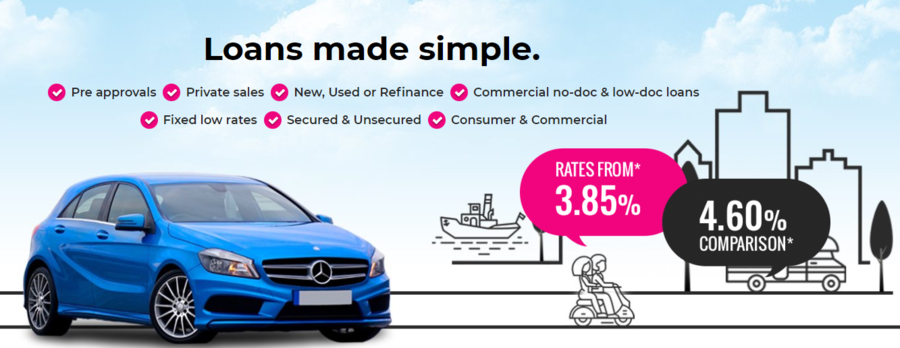

MELBOURNE, AUSTRALIA, January 27, 2022 /24-7PressRelease/ -- Leading finance broker National Loans, who provides asset finance including car and boat finance as well as caravan finance and motorbike finance, says that while buying a used asset privately typically involves more documentation, higher interest rates and limits on the age of the asset, there is often more room for negotiation on price. Additionally, it's the previous owner who takes the depreciation hit.

According to National Loans, there is some risk involved with purchasing a used asset as it won't come with warranties or other protections that dealer sales typically have. Lenders often view used private sales as riskier too and may only offer an unsecured personal loan rather than private sale asset finance, which will likely result in a higher interest rate.

Led by a management team with over two decades of experience in the asset finance industry, National Loans is well versed in finding the best loans for customers - from comparing all the options in the market to ensure the borrower gets the best deal possible, to liaising with the seller to get all the right documentation in place.

To secure a private sale asset loan, National Loans advises borrowers to apply for pre-approval first, which allows them to shop with confidence. The lender will want to ensure everything is above board with the asset being purchased, so will require additional information before the deal goes through.

National Loans explains that additional information a lender may require includes the registration certificate, vendor's license and proof of banking details, inspection report and copy of the sale agreement. If the asset is already under finance, the vendor will either have to pay out the loan or provide a payout letter from their existing lender.

For more information about a car or boat loan for a private sale, speak to the experts at National Loans.

# # #

Contact Information

National Loans

Melbourne, Victoria

Australia

Voice: 1300 358 358

E-Mail: Email Us Here

Website: Visit Our Website

Blog: Visit Our Blog