All Press Releases for February 17, 2022

With Recreational Boat and Caravan Sales Soaring, National Loans Explains How Asset Finance Works

When COVID-19 first arrived in Australia and the country went into lockdown, boat and caravan retailers held their breath and prepared for the worst. As it turned out, the opposite occurred, with boat and caravan sales soaring.

MELBOURNE, AUSTRALIA February 17, 2022 /24-7PressRelease/ -- According to leading finance broker, National Loans, who offers various types of asset loans including boat finance and caravan finance, owning a boat or caravan opens up a world of possibilities, with many Aussies choosing to stay home over the summer amidst the Omicron outbreak. For many, caravans and boats symbolise freedom and rightly so as they provide the opportunity to get away at any time.

Regardless of whether buyers are first timers or have previously owned a boat or caravan and are upgrading, National Loans recommends buyers consider their goals. Determining what they plan to do with their boat or caravan and where they plan to go will help to decide the type and specs that best suit their needs.

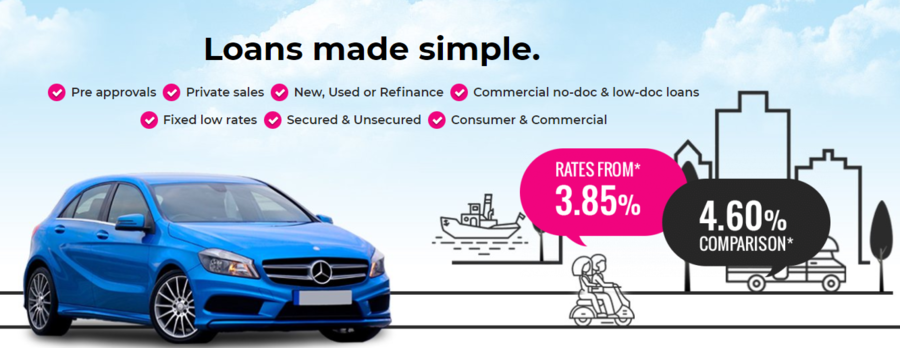

National Loans explains that financing a boat or caravan is similar in many ways to car finance. The loans can be secured (using the asset as collateral) or unsecured. The interest rate charged on the loan reflects the risk the deal poses to the lender. National Loans says that as rates vary widely from lender to lender, it always pays to compare the market to find the best possible deal.

For those asking what the best way is to finance a boat or caravan purchase, National Loans says there are three options: go direct to a bank or lender, get dealer finance or use a finance broker. While going direct to the lender or securing dealer finance is often convenient, it can limit the options for the purchaser.

Finance brokers like National Loans work with many lenders including boat and caravan finance specialists. They can compare all available options to ensure the buyer secures a competitive rate and terms to suit their needs and circumstances.

To secure a caravan or boat loan or discuss other asset finance such as motorbike finance, contact National Loans.

# # #

Contact Information

National Loans

Melbourne, Victoria

Australia

Voice: 1300 358 358

E-Mail: Email Us Here

Website: Visit Our Website

Blog: Visit Our Blog